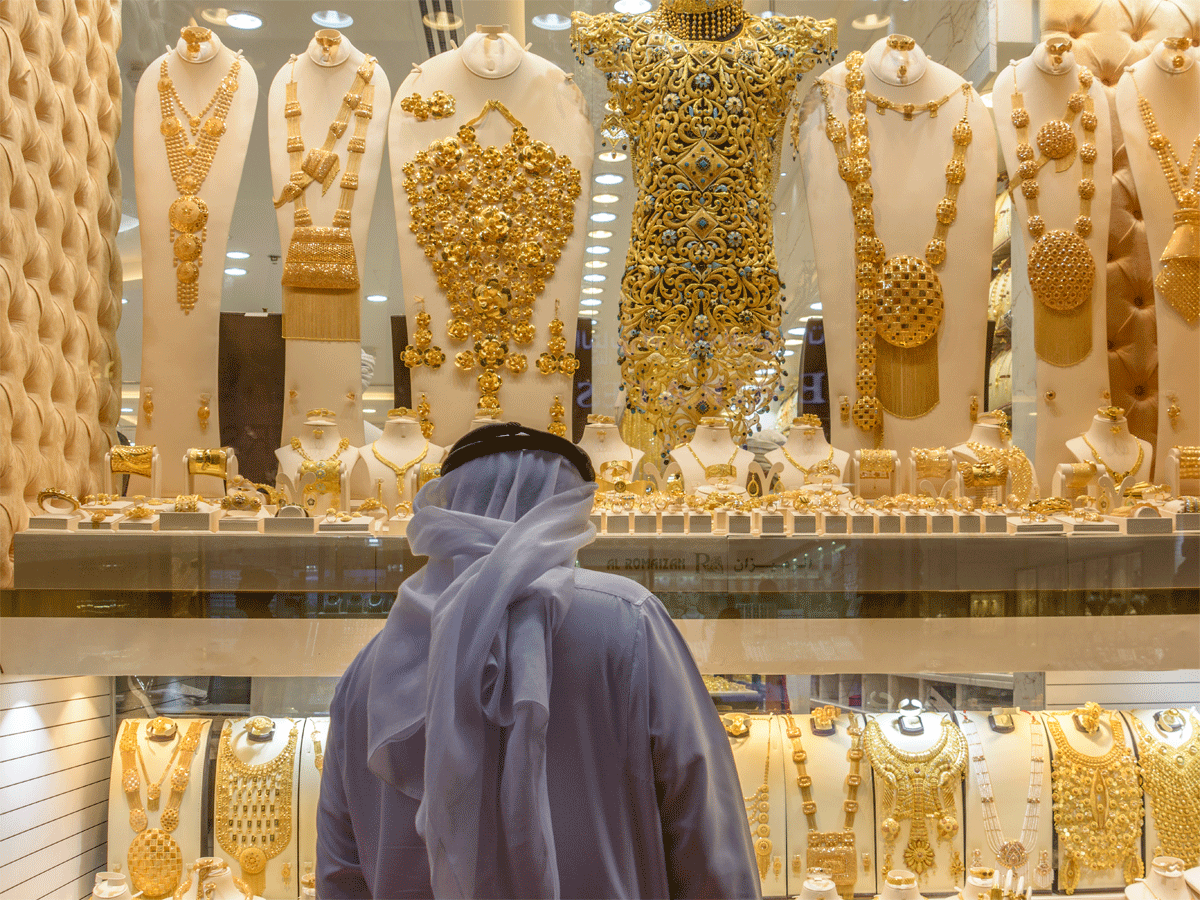

The government has not only made hallmarking of gold mandatory but has also revised the symbols of hallmarking to be inscribed on gold. It is important for consumers to check these three signs that will verify the purity of gold bought by them. Here is a look at what these three symbols denote.

The government has not only made hallmarking of gold mandatory but has also revised the symbols of hallmarking to be inscribed on gold. It is important for consumers to check these three signs that will verify the purity of gold bought by them. Here is a look at what these three symbols denote.from Personal Finance News-Wealth-Economic Times https://ift.tt/BpMEZko