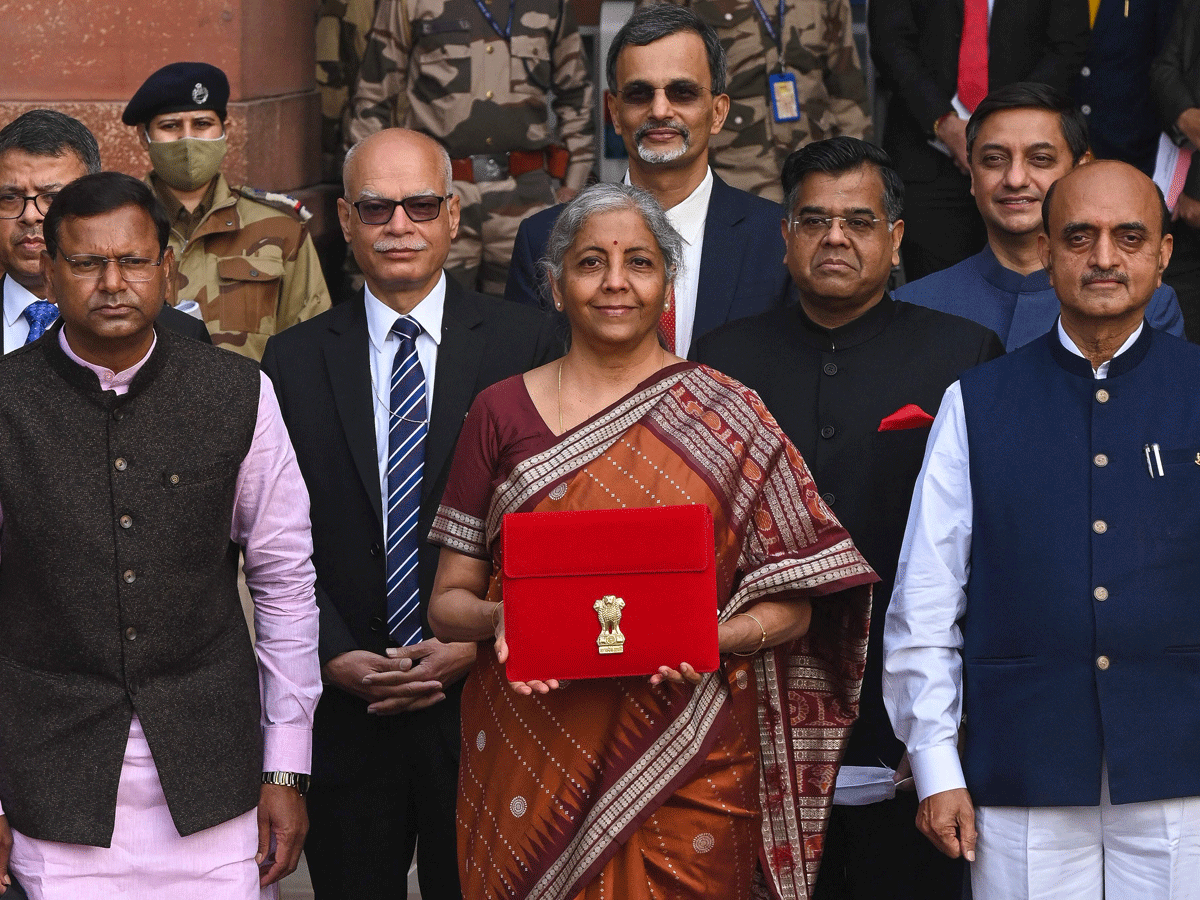

Introduction of Digital currency by central bank will lead to cheaper currency management. The FM said that the digital rupee issued by RBI will use blockchain technology starting from Fy 2022-23.

Introduction of Digital currency by central bank will lead to cheaper currency management. The FM said that the digital rupee issued by RBI will use blockchain technology starting from Fy 2022-23.from Personal Finance News-Wealth-Economic Times https://ift.tt/isJD9CtBb