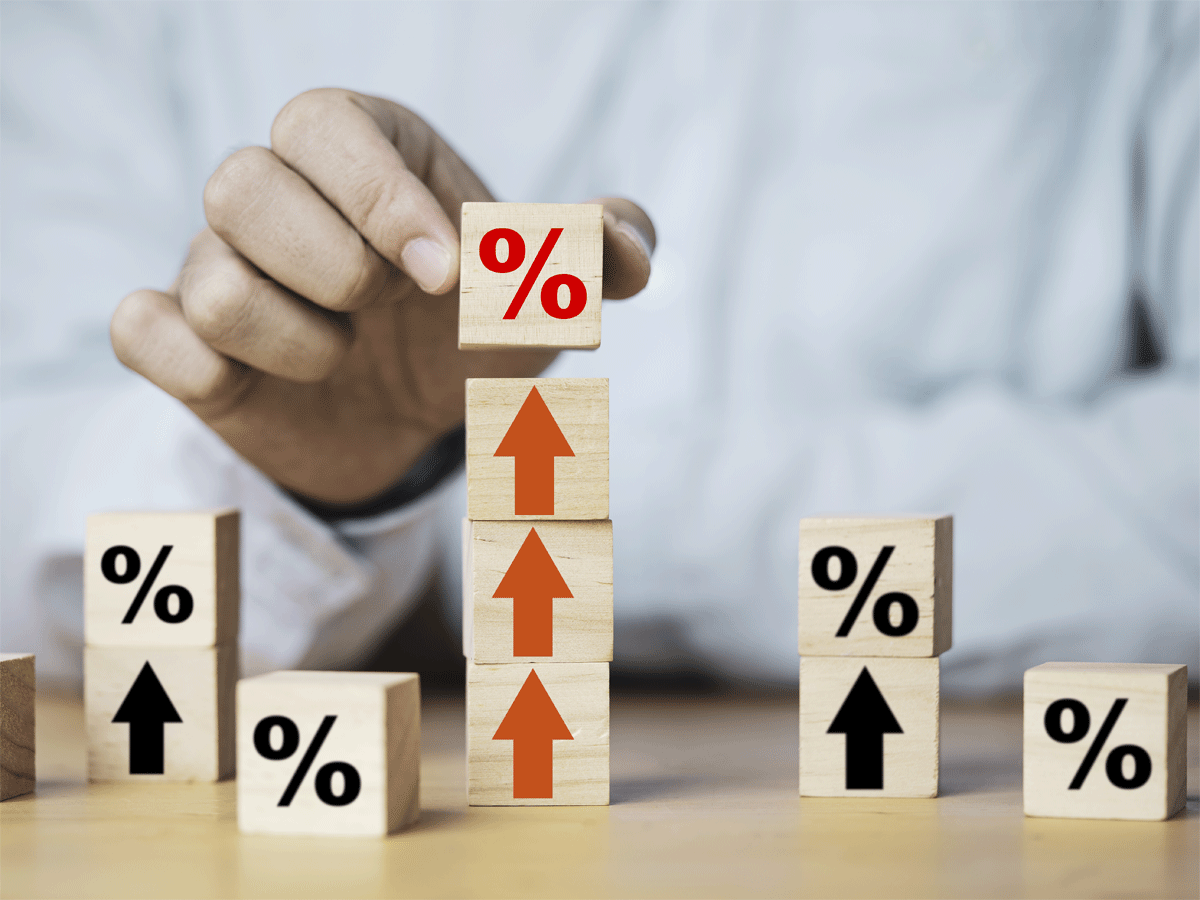

The Reserve Bank of India (RBI) has hiked the interest rate on floating rate savings bonds from 7.15 per cent to 7.35 per cent from January 1, 2023. The hike in interest rate on these bonds have come up after government hiked the interest rate on small savings schemes for January to March quarter of financial year 2022-23.

The Reserve Bank of India (RBI) has hiked the interest rate on floating rate savings bonds from 7.15 per cent to 7.35 per cent from January 1, 2023. The hike in interest rate on these bonds have come up after government hiked the interest rate on small savings schemes for January to March quarter of financial year 2022-23.from Personal Finance News-Wealth-Economic Times https://ift.tt/f9GSDiA